Bitcoin, which was expected to break through $100,000 soon, has suddenly fallen back to the $80,000 range.

What's even more frustrating for the crypto world is that outside of it, the scenery is uniquely favorable. Gold and silver have hit new highs, with gold breaking through $5,000, the Russell 2000 index has outperformed the S&P 500 for 11 consecutive days, and China's STAR 50 index has gained over 15% in a single month.

The调侃 of the "ABC Investment Method" (Anything But Crypto) continues to play out in reality. Why is everything except the crypto market rising? And why has the market, which welcomed Trump, been falling incessantly?

From macro to micro, from external to internal, the market seems to be brewing a larger storm: the White House faces another shutdown, Japan continues its monetary tightening, the uncertainty of Trump and his policies, as well as capital flight and meme coin吸血 within the crypto market.

The Macro "Three Mountains"

The White House Is About to "Shut Down" Again

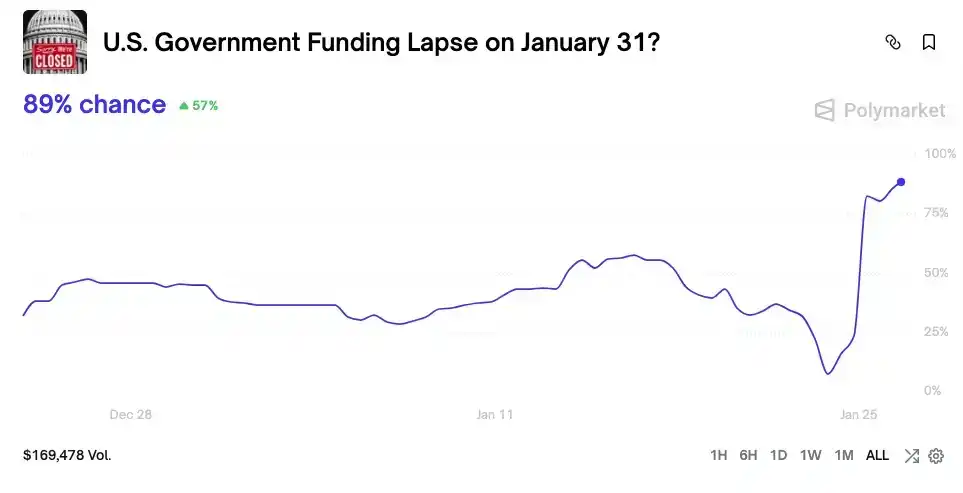

The U.S. government is once again on the brink of a shutdown. Due to another incident of federal law enforcement officers shooting and killing someone in Minnesota, Democratic senators collectively opposed the funding bill that included the Department of Homeland Security's budget, causing the shutdown risk on Polymarket to soar to 80% on January 30.

A government shutdown means frozen fiscal支出, with hundreds of billions of dollars locked in the Treasury General Account (TGA) unable to flow into the market. The TGA becomes a financial black hole that only takes in and does not let out, sucking liquidity from the market. The shutdown in October 2025 sucked over $200 billion from the market in just 20 days, equivalent to multiple rounds of interest rate hikes.

When the banking system's reserves are heavily siphoned by the TGA, the cost of funds in the market soars. The first to feel the chill is always the crypto market, which is most sensitive to liquidity.

Looking back at the 43-day shutdown in October 2025, Bitcoin's price movement was quite dramatic:

• Early shutdown (October 1-10): Bitcoin hit a historic high of $126,500 on October 6. The market generally believed that the government shutdown would highlight the value of decentralized currency.

• Mid-shutdown (October 11-November 4): The shutdown lasted longer than expected. During the policy vacuum period when everyone thought the dust had settled, the crypto market experienced the 1011 liquidity black swan event, plummeting to $102,000, a drop of over 20% from the high.

• Late shutdown (November 5-12): The price fluctuated around $110,000 and did not immediately rebound as the shutdown was about to end.

Once bitten, twice shy. This time, the market's reaction to the government shutdown was more direct and rapid. Within 24 hours of the shutdown risk soaring, Bitcoin fell from $92,000 to below $88,000. The market seems to have learned from last time, no longer viewing a government shutdown as a利好, but directly pricing it as a liquidity利空.

Japan's "Butterfly Effect"

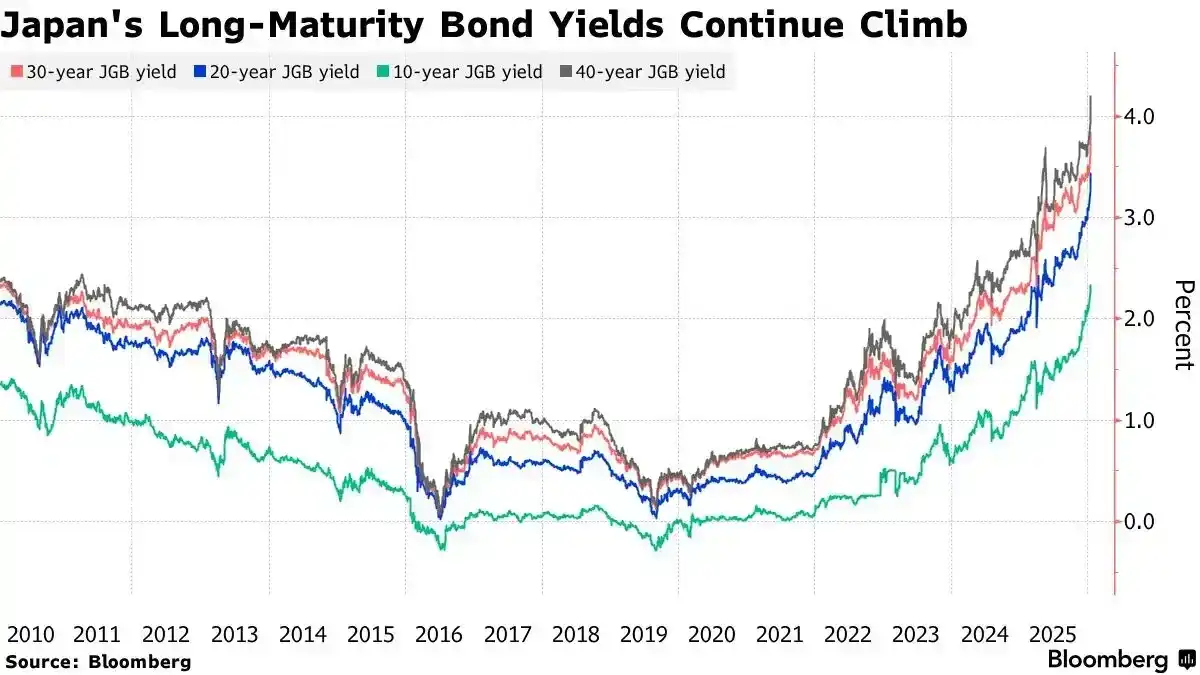

Another straw that broke the camel's back came from Tokyo. On January 19-20, 2026, the yield on Japan's 10-year government bonds soared to 2.330%, hitting a 27-year high.

Expectations of Bank of Japan rate hikes and fiscal expansion push government bond yields to their highest since 1999

Behind this is the reversal of the Yen carry trade. In the past, investors borrowed low-interest Yen, converted it to US dollars, and invested in high-yield assets (such as US Treasury bonds and Bitcoin).

But now, the Bank of Japan has begun raising interest rates (raised to 0.75% in December 2025), and the new Prime Minister, Takaichi Sanae, announced an end to fiscal austerity, planning large-scale investment and tax cuts. This has sparked serious market concerns about Japan's fiscal situation, leading to a sell-off in government bonds and soaring yields.

More importantly, the fundamentals of Japan's economy are supporting this high interest rate becoming a long-term trend. Data from the Ministry of Internal Affairs and Communications shows that in November 2025, Japan's unemployment rate remained stable at 2.6%, marking 59 consecutive months of "full employment." The strength of the labor market gives the Bank of Japan the confidence to continue raising rates. This Friday (January 31), Japan will release the December unemployment rate, which is widely expected to remain low, further strengthening expectations of rate hikes.

The surge in Japanese government bond yields has pushed up global borrowing costs and further compressed the interest rate differential of the Yen carry trade. Carry traders are forced to close their positions, selling dollar-denominated assets to buy back Yen. The resulting global market liquidity squeeze seems set to continue.

The "Risk-Off" Period Before Key Data

At 3 AM Thursday (Beijing Time), the Fed's FOMC will announce its interest rate decision, and Fed Chair Powell will hold a monetary policy press conference; on Friday, Japan will release its December unemployment rate, and the US will release its December PPI data.

During this key week of data releases, large funds generally choose to enter a "quiet period," reducing risk exposure and waiting for uncertainties to resolve. This risk-off sentiment has further exacerbated the selling pressure in the market.

Historical data shows that in the 5-7 days before the FOMC decision is announced, Bitcoin prices tend to be weak, showing a pattern of "pre-meeting decline." For example, before the December 2025 FOMC meeting, Bitcoin fell from a high of $94,000 to around $90,000. And before the October 2025 meeting, Bitcoin also fell from $116,000 to below $112,000.

Behind this pattern is the risk-averse operation of large institutional investors. Before the Fed's policy becomes clear, they tend to reduce their positions in risk assets to cope with possible unexpected policy changes.

The "Seesaw" of Liquidity

Without incremental macro liquidity, both global markets and the internal crypto market are facing a存量博弈 of liquidity. Crypto liquidity is being siphoned by all markets, and the liquidity of mainstream coins like BTC is being siphoned by meme coins.

Bitcoin ETF vs. Gold ETF

If macro factors are long-term worries, then the flow of funds is a more immediate concern.

The approval of Bitcoin spot ETFs in early 2025 was once seen as the "engine" of the bull market. But data shows that since mid-January, the inflow of funds into ETFs has significantly slowed, even experiencing net outflows for 5 consecutive days, totaling $1.7 billion.

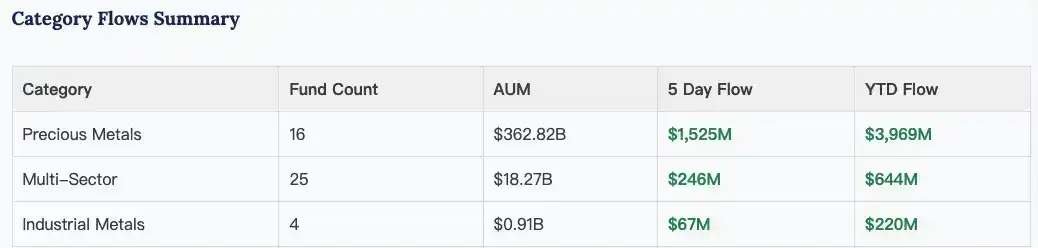

At the same time, gold and silver ETFs continue to attract funds. In 2025, gold ETFs recorded their strongest inflows since 2020, with total holdings increasing by over 220 tons.

Entering 2026, this trend continues. In the first three weeks of January, net inflows into precious metal ETFs like gold and silver reached $4 billion.

Precious metal ETFs have seen total inflows of about $4 billion since January | Source: ETF Action

This stark contrast reflects a fundamental shift in market risk appetite. Against the backdrop of increased macro uncertainty, funds are flowing from high-risk Bitcoin to traditional safe-haven assets like gold and silver.

Meme Coins Are Sucking Blood Again

Under the macro winter, the internal crypto market presents a split scene of ice and fire. On one side, Bitcoin keeps falling阴跌不止, on the other side, it's the狂欢 of Meme coins.

A Solana Meme coin named "Nietzschean Penguin" ($PENGUIN) surged a hundredfold in two days because the official White House Twitter account posted an AI-generated image of Trump with a penguin, and its market cap once reached $170 million.

Behind this phenomenon is极度压抑 market sentiment.

When macro narratives fail, value investing fails, the inflow of incremental funds from ETFs slows down, and the crypto market loses its wealth effect after 1011,存量资金 begin to flock to Meme coins, seeking short-term致富 opportunities.

This is a心态 of "末日狂欢" and "wanting to break even":既然价值币不涨, then只好去赌空气币.

But often, this "chasing rallies" and "breaking even" sentiment of investors is更容易 captured and harvested by "做局者". "Nietzschean Penguin" received multiple retweets from A16Z, Solana's official Twitter, the White House, and Musk's account within two days, which is hardly "unprepared".

The White House official Twitter account posted three "penguin" related tweets in two days

Looking back at the past, $Trump, $币安人生, every time情绪火热,背景强势的速通盘后, it seems to be followed by a暴跌 in the broader market. The spread of this sentiment further抽走了 mainstream coin liquidity, forming a恶性循环.

It's just that the current crypto liquidity is much worse than in December 2024 and October 2025, so the retweets from the White House and一众 Twitter big shots催熟, the upper limit of "Nietzschean Penguin" has so far only stayed below 200M.

Will the Storm Continue?

Although the debate about BTC's "four-year cycle" is intensifying, since Bitcoin fell below $110,000 on October 11, 2025, the crypto market seems to have entered a bear market, with liquidity becoming increasingly thin during three months of震荡.

But this time, the situation we face is more complex. The short-term trend will depend on the political games in Washington, the policy signals from the Fed, and the earnings reports of tech giants.

From a longer-term perspective, the global economy seems to be already风声鹤唳 due to geopolitics, deeply trapped in the debt-watering-bubble cycle and unable to extricate itself.

And Trump remains a "bomb" that could detonate at any time.

On January 17, the Trump administration threatened to impose 10% import tariffs on eight European countries, including Denmark, Norway, Sweden, France, and Germany, to pressure them to make concessions on the Greenland issue. Although Trump temporarily abandoned the tariff threat after meeting with the NATO Secretary General on January 21, the "art of the deal" is still full of uncertainty.

On January 24, Trump threatened to impose 100% tariffs on all Canadian exports to the US to prevent it from reaching a trade agreement with China.

No one can predict what "crazy" move he will make next for his mid-term election reelection.

For investors, now may not be a good time to chase the rally in other assets. In the "January Siege," maintaining patience and caution, waiting for the macro fog to clear, may be the only choice.